Business and finance

The UK's finance sector is one of its major employers and contributors to economic growth. One of the core functions of this sector is to aid monetary transactions between individuals and businesses. There are many roles in this field, including those related to commercial banking and insurance.

-

Useful skills

- Commercial and business awareness

- Communication and presentation skills

- An analytical approach to work

- High numeracy and sound technical skills

- Problem-solving skills and initiative

- Negotiation skills and the ability to influence others

- Strong attention to detail and an investigative nature

-

Related subjects

- Accountancy and finance

- Business

- Economics

- Management

- Mathematics

- Statistics

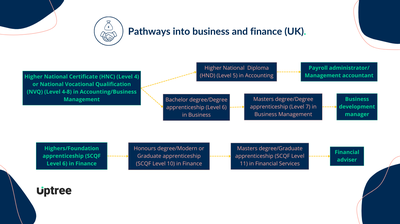

Explore the pathways to get into business and finance

-

Apprenticeship

You can enter business and finance through apprenticeships like:

- business services apprenticeship

- global banking admin apprenticeship

- investment solutions apprenticeship

You'll usually need:

- 4 or 5 GCSEs at grades 9 to 4 or National 5s at grades A to C; and A levels or Scottish Highers, or equivalent, for a degree or graduate apprenticeship

-

College

You could study a college course in sales or business. If you want to start a junior role, you could take on qualifications like:

- Level 3 Award in Business Development Skills

- Level 3 Certificate in Sales and Account Management

You'll usually need:

- 4 or 5 GCSEs at grades 9 to 4 or National 5s at grades A to C, or equivalent, for a level 3 course

-

University

Relevant degree subjects include:

- business management or development

- accountancy

- economics

- international relations

- finance

You'll usually need:

- 2 to 3 A levels or Scottish Highers, or equivalent, including maths, for a degree

- a degree in a relevant subject for postgraduate study

-

Work

Following your school or college studies, you could apply for various positions in business and finance:

- bank customer service

- finance assistant or accounts assistant

You'll usually need:

- at least 5 GCSEs at grades 9 to 4 or National 5s at grades A to C, including English and maths, or equivalent qualifications.

You could take further training on the job while you study for management qualifications.

Explore online careers courses

Browse upcoming events

Jobs in business and finance

Check out live jobs and placements

Uptree partner companies in business and finance

Did you know?

Artificial intelligence (AI), as a key economic game changer in the future, has the potential to add $15.7 trillion to the global economy by 2030.